Widowhood is the Highest Poverty and Lowest Remarriage Demographic

Advocacy for more research into widowhood is essential.

You could say I’m a bit of a data geek. So, when Hurricane Milton hit, and I found myself with some internet but our HQ office hours lessened, I naturally fell down the rabbit hole of studying the world’s most invisible and forgotten women—widows.

Some people call me the “go-to leader for all things widowhood, research, advocacy, and support,” but really, I’m just curious. I love connecting the dots. One of my strengths is connectedness, and I’ve long used it to untangle the complexity surrounding the invisibility of widows in research and initiatives. I guess you could say I’m a bit of a Sherlock Holmes type—minus the pipe, of course.

What puzzles me is that widowed women (and men) are among the highest poverty demographics, yet very little research exists on how that poverty, coupled with living alone and social isolation, impacts long-term health. Sometimes I find myself wondering, “Do people (and funders) just not care about this population as much?” But I know it’s more than that. The issue is massive, and finding solutions is daunting.

One solution I’ve seen work is simple: when you uplift a widow’s income, support, and stability, their health improves. It’s a direct connection, but sadly, most research on widows focuses on those over 65. The younger widows—like me—are largely left out of the equation. So, most studies are centered around Social Security and retirement benefits.

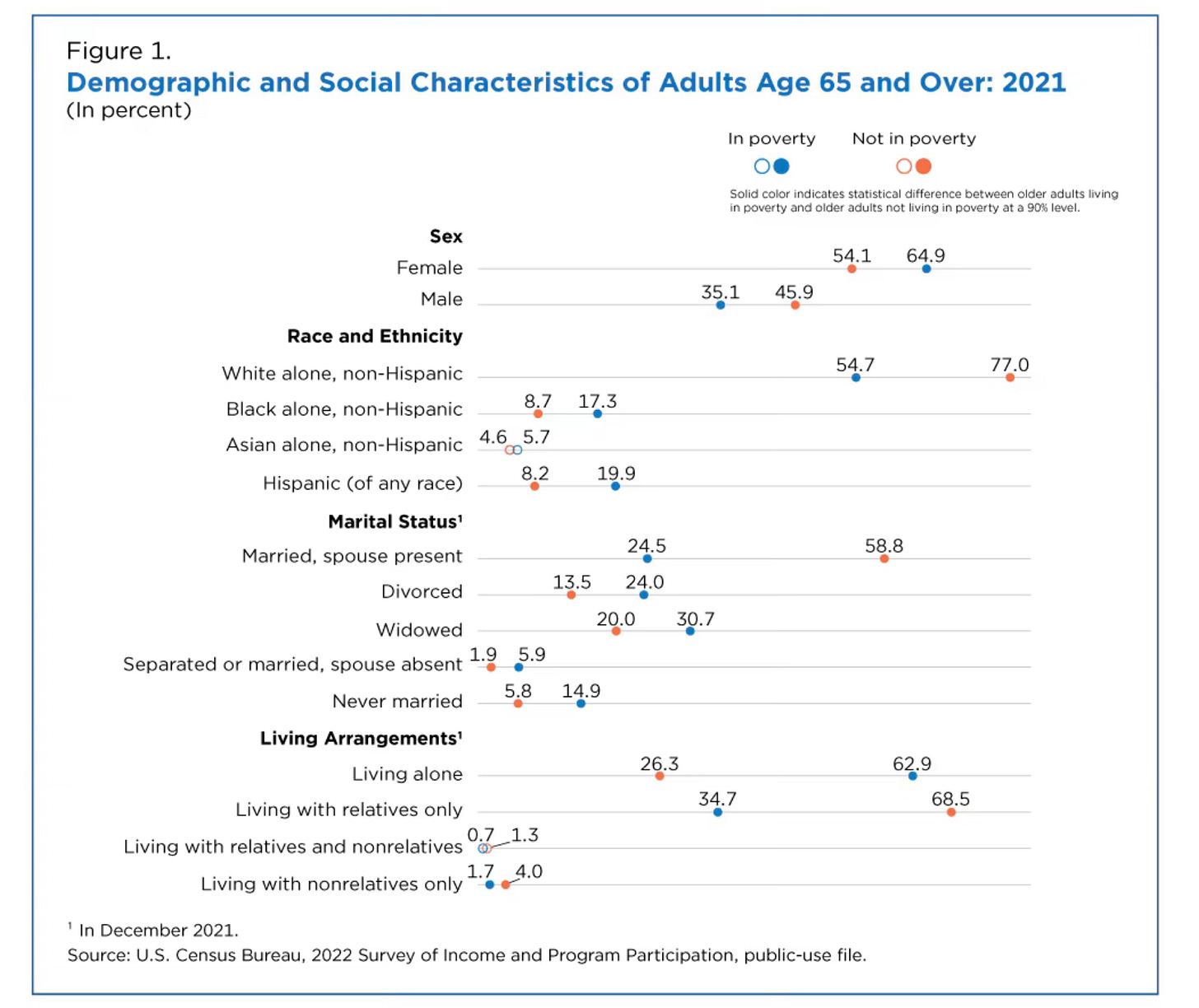

Here’s a striking statistic from one chart I recently reviewed:

“This indicates that while Social Security helps lift a large number of people age 65 and over out of poverty, many Social Security recipients remain poor.” The reality is that without retirement funds, real estate income, or other earnings, Social Security can only stretch so far.

We’ve found in our own database that for many women, widowhood brings a drastic shift in income. And that financial instability often has a ripple effect on their health, emotional well-being, and overall quality of life.

It’s a tough challenge to solve, but one thing is clear: helping widows achieve financial stability is key to improving their long-term health outcomes. So, for now, I’ll keep following the clues, one data point at a time.

The chart highlights an important fact: “While Social Security helps lift a significant number of people aged 65 and over out of poverty, many recipients still remain poor.” Without additional sources of income, such as retirement savings, real estate earnings, or other income streams, Social Security can only stretch so far.

In our own database, we've found that income often changes drastically when a woman faces widowhood, leaving many to navigate financial instability on top of their grief.

Before widowhood, 32.4% of widows reported a household income of over $110,000. However, after losing their spouse, that number plummeted to just 10.3%, with even fewer feeling comfortable sharing this financial data.

We also inquired about the lower end of income, asking how many widows were earning less than $30,000 before widowhood. Only 4.1% reported being in this income bracket.

However, when we asked how many had an income of less than $30,000 after widowhood, that figure rose to 19.1%, with more individuals willing to share their responses.

Keep reading with a 7-day free trial

Subscribe to Widow Life™ to keep reading this post and get 7 days of free access to the full post archives.